Some recent proposals to lower prescription drug costs would require drug manufacturers to pay a rebate to the federal government if their prices for drugs covered under Medicare Part B and Part D increase by more than the rate of inflation. This proposal is included in recent legislation passed by the Senate Finance Committee (S. 2543, Prescription Drug Pricing Reduction Act of 2019) and introduced by Speaker Pelosi in the House of Representatives (H.R. 3, Lower Drug Costs Now Act of 2019). The Administration’s FY2020 budget includes a related proposal that applies only to drugs covered under Part B. (See Table 1 for a comparison of these proposals.) The Medicaid program currently has a similar policy in place.

This data note analyzes changes in list prices for drugs covered by Medicare Part D in recent years compared to changes in the rate of inflation. The analysis is based on data from the CMS’s most recent Medicare Part D drug spending dashboard. Changes in list prices for Part D drugs are measured by one-year (2016-2017) and three-year (2014-2017) changes in average spending per dosage unit amounts reported in the dashboard. We compare these changes to the rate of increase in the Consumer Price Index for all urban consumers (CPI-U) over the same time periods. We analyze price changes for all drugs reported in the dashboard in 2017, along with the top 10 drugs by total Medicare Part D spending and the top 10 most commonly-used drugs in Part D in 2017 that had price increases between 2016 and 2017 above the rate of inflation. (See Methods for additional details.)

This analysis provides context for understanding the basic approach of an inflation rebate policy. It is not an analysis of any specific provision in either the House or Senate bills nor is it similar to a CBO cost estimate. Our analysis is based on unit prices that do not reflect manufacturer rebates and discounts to plans, which are considered proprietary and therefore not publicly available; the Senate Finance Committee inflation rebate proposal is also based on list prices (Wholesale Acquisition Cost), while the House proposal is based on Average Manufacturer Price, which may include some discounts to wholesalers but not rebates paid to plans and PBMs.

Key Findings

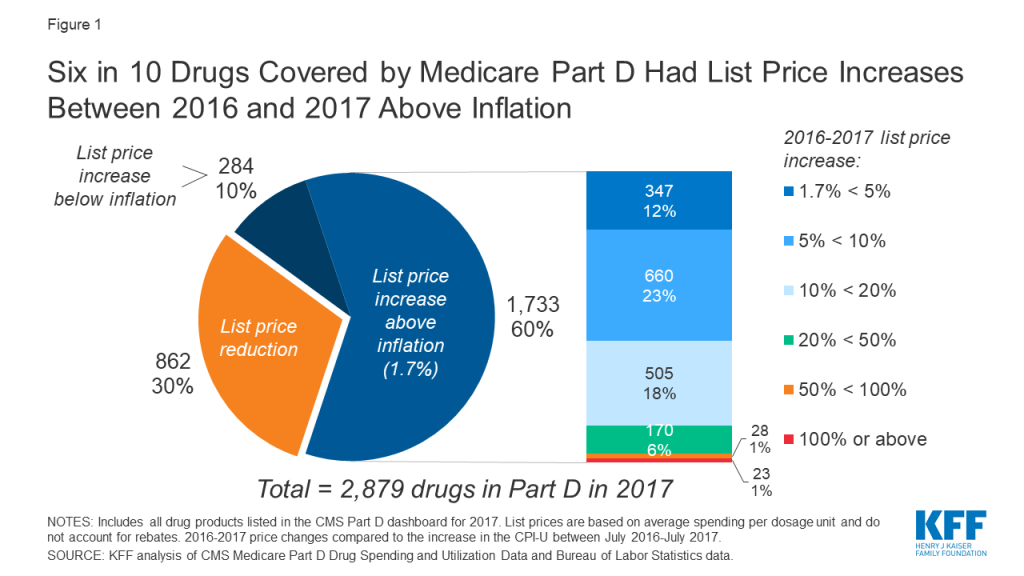

- For many drugs covered by Medicare Part D in 2017, list prices increased faster than inflation by several percentage points. Of the 2,879 drugs reported in 2017 in the Part D dashboard, including both brand-name and generic drugs, 60% (1,733 drugs) had list price increases that exceeded the inflation rate between July 2016 and July 2017, which was 1.7%.

- Among the top 25 drugs by total Medicare Part D spending in 2017, all of which were brand-name drugs, 20 had list price increases between 2016 and 2017 that exceeded the inflation rate, in some cases by several percentage points; for example, 15.7% for Lyrica, a pain medication, 15.3% for Revlimid, a cancer medication, and 13.2% for Humira Pen, for rheumatoid arthritis. For these 20 drugs, price increases ranged from 3 times to more than 9 times the rate of inflation.

- Among the 96 drugs used by more than 1 million Part D enrollees in 2017, roughly one-fifth of these drugs (22 drugs) had list price increases between 2016 and 2017 above the rate of inflation. Of the 22 most-commonly used drugs with price increases above inflation, 17 were generics (77%); half of the products (11) had list price increases below 5%, while price increases for the remaining half of products ranged from 6% to 32%–or 3 to 18 times the rate of inflation.

Findings

Want to publish your own articles on DistilINFO Publications?

Send us an email, we will get in touch with you.

PRICE CHANGES AMONG ALL DRUGS COVERED BY PART D

Of the 2,879 drugs reported in 2017 in the Part D dashboard, including both brand-name and generic drugs, 60% (1,733 drugs) had list price increases that exceeded the inflation rate between July 2016 and July 2017, which was 1.7% (Figure 1). One-fourth of all Part D drugs had price increases of at least 10% between 2016 and 2017, and more than one-third (35%) had price increases above the rate of inflation but below 10%. Another 284 drugs (10%) had price increases below inflation, while for the remainder (859 drugs, or 30%), list prices decreased between 2016 and 2017.

PRICE INCREASES AMONG TOP DRUGS BY TOTAL PART D SPENDING

Focusing on the top 25 drugs by total Medicare Part D spending in 2017, all of which were brand-name drugs, 20 had list price increases between 2016 and 2017 above the inflation rate (Table 2). For these 20 drugs, price increases ranged from 3 times to more than 9 times the rate of inflation.

Among the top 10 of this subset of drugs, list price increases exceeded the inflation rate by several percentage points, including four drugs with double-digit increases: 15.7% for Lyrica, a pain medication used by 0.9 million Part D enrollees in 2017; 15.3% for Revlimid, a cancer medication used by 37,000 enrollees; 13.2% for Humira Pen, for rheumatoid arthritis, taken by 52,000 enrollees; and 11.0% for Novolog Flexpen, an insulin therapy used by nearly 550,000 enrollees (Figure 2). Four of these 10 drugs are taken by roughly one million or more Part D enrollees (Eliquis, Xarelto, Advair Diskus, and Symbicort).

Source: KFF