For the third year running, our smart friends from across the healthcare industry helped us take the pulse of the health IT sector. Our respondents have correctly called both the survival of the Affordable Care Act (even without bugging Justice Roberts’ chambers) and the lack of tangible progress in drug pricing. This year, we re-checked on startup health, technology adoption and regulatory issues while also taking a look at new topics including blockchain and diversity.

Our commentary on the most interesting findings are presented below.

I. TIPPING POINT OR PEAK BULL?

We might be at the outset of a huge innovation cycle, or we could be late into an aging, over-capitalized market. Opinions point in both directions.

OPTIMISM CONTINUES FOR HEALTH IT COMPANIES

Want to publish your own articles on DistilINFO Publications?

Send us an email, we will get in touch with you.

The overall sector sentiment is enthusiastic, with increased expectations for new company creation and decreased concerns about funding. With talent predicted as the biggest challenge ahead and funding predicted as the least, we have increased evidence of a frothy market. Or simply extreme bias/hope by overly committed ecosystem participants?

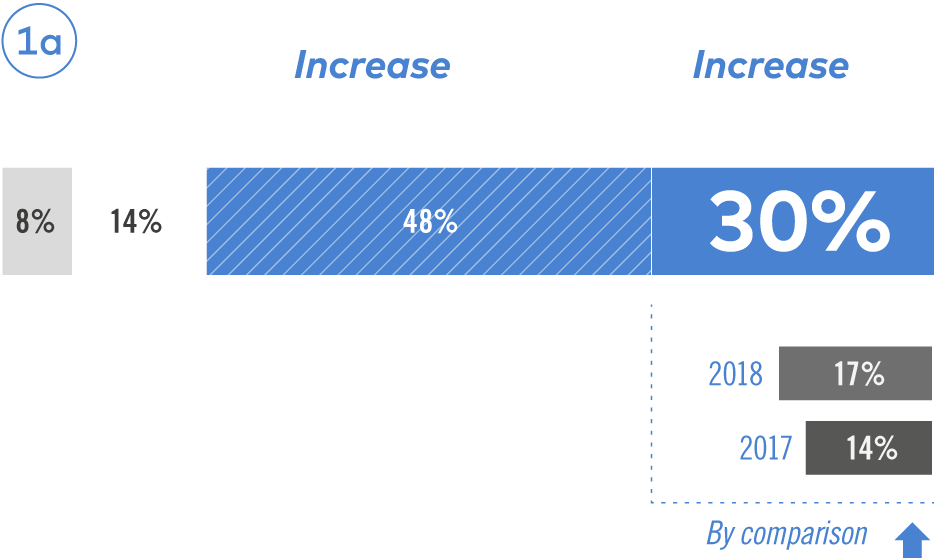

1a Over the next two years, the creation of new healthcare IT companies will…

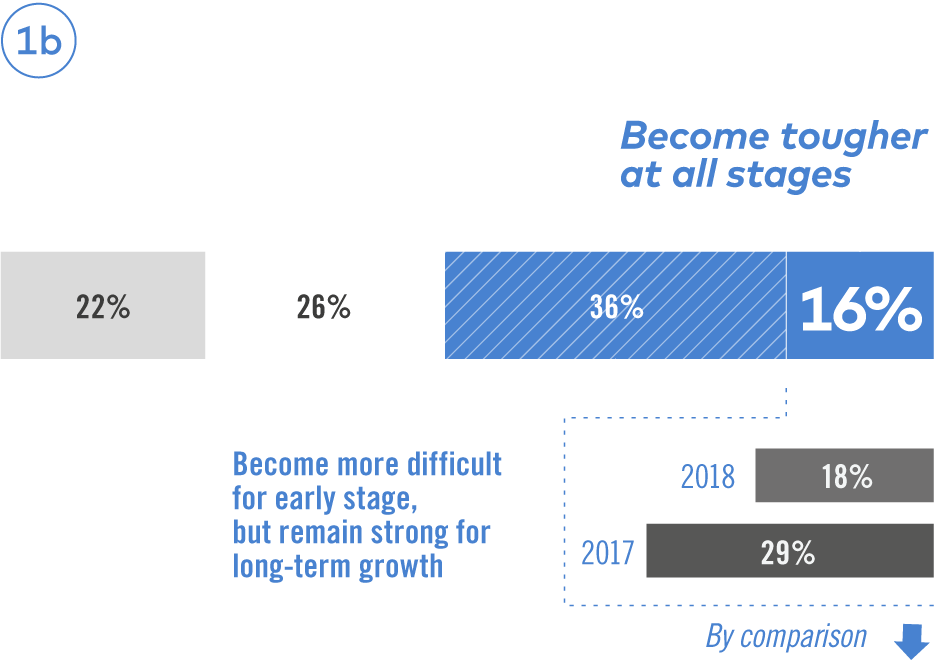

1b What will happen to the capital markets for private healthcare IT companies?

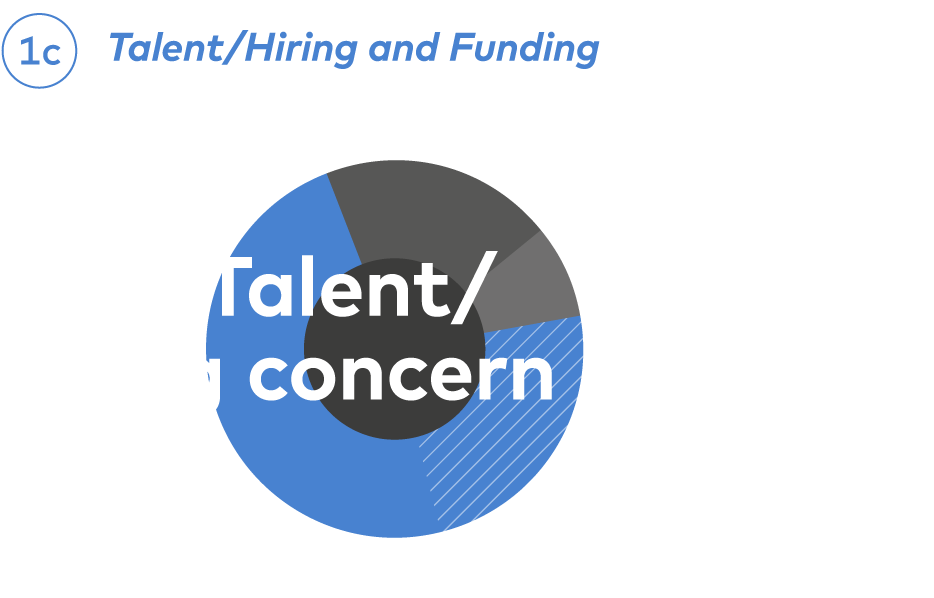

1c How concerned are you about each of the following challenges to healthcare IT innovation in the next 12 months?

BUT NOT SO FAST

While people are upbeat on the sector overall, most are pessimistic on specific deals. Unicorns are overvalued and few people regret missing out on deals. When 2/3 of people still wouldn’t want the most popular deal…

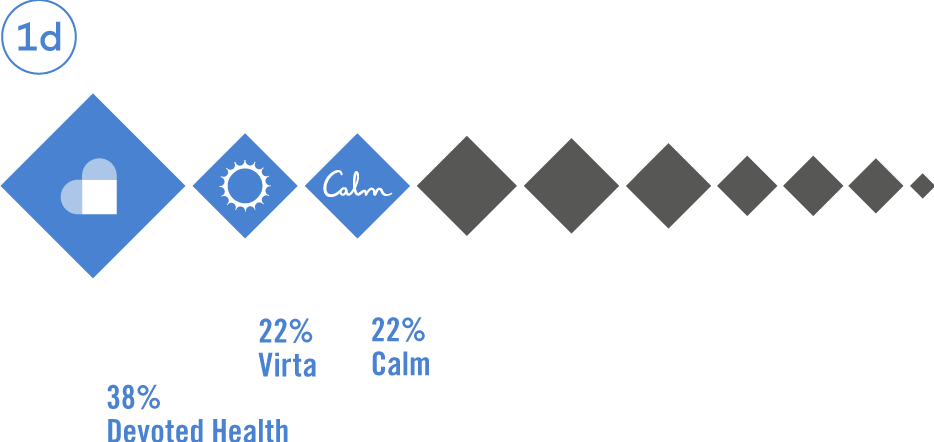

1d Which of the following 2018 early stage (A & B) financings do you regret not having been in?

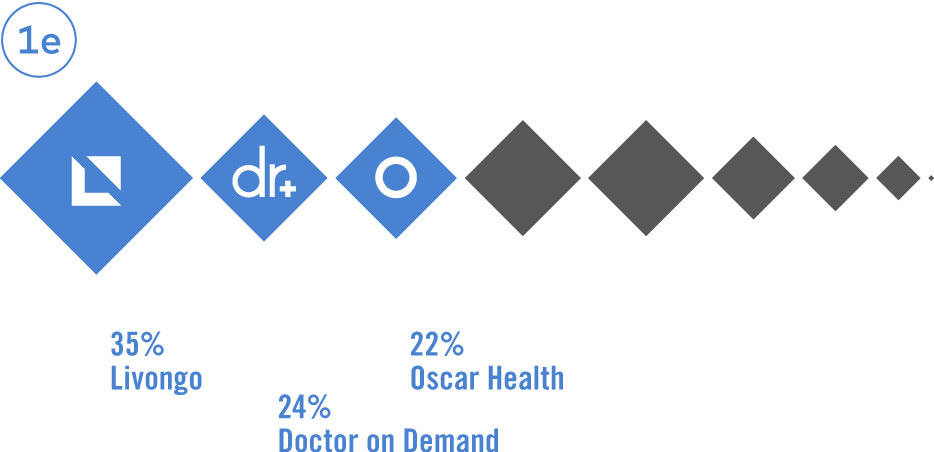

1e Which of the following 2018 later stage (Series C on) financings do you regret not having been in?

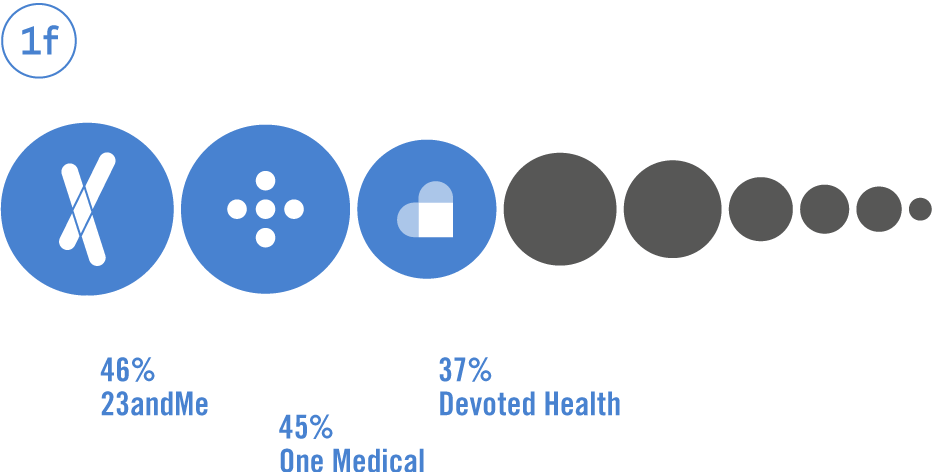

1f I believe the following ‘unicorn’ valuations are in line with their market potential

II. IT’S POLITICAL

With the repeal and replace debate on the back burner (or at least in the courts) and an industry now adapted to a new administration (until something totally unpredictable gets tweeted next week), people took a calmer, though perhaps more jaded view, of progress in health policy.

POLICY PAUSE UNTIL 2021

With tempered concerns over regulatory changes, the industry has very low expectations that the mid-term elections will lead to positive changes for the US healthcare system.

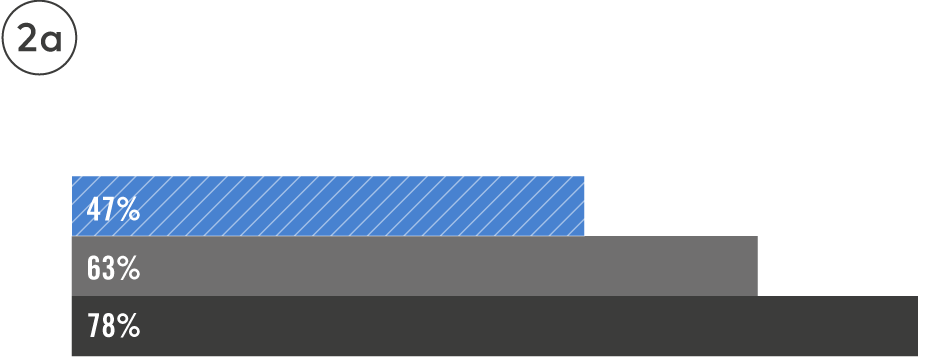

2a How concerned are you about each of the following challenges to healthcare IT innovation in the next 12 months?

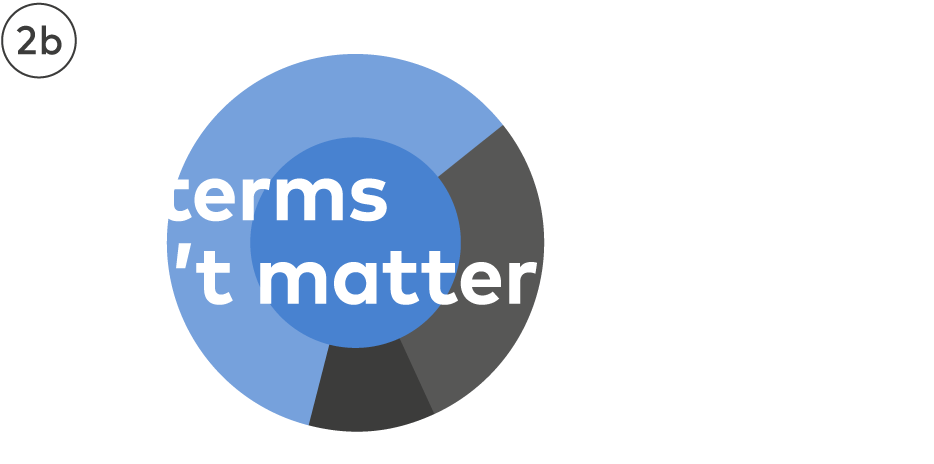

2b How will the results of the midterm elections impact the future of the US healthcare system?

THERE’S HOPE FOR DRUG PRICING

People are more optimistic that drug prices will be curtailed as a bipartisan effort by congress is underway. Respondents clearly feel that the pharma industry is unlikely to do it voluntarily.

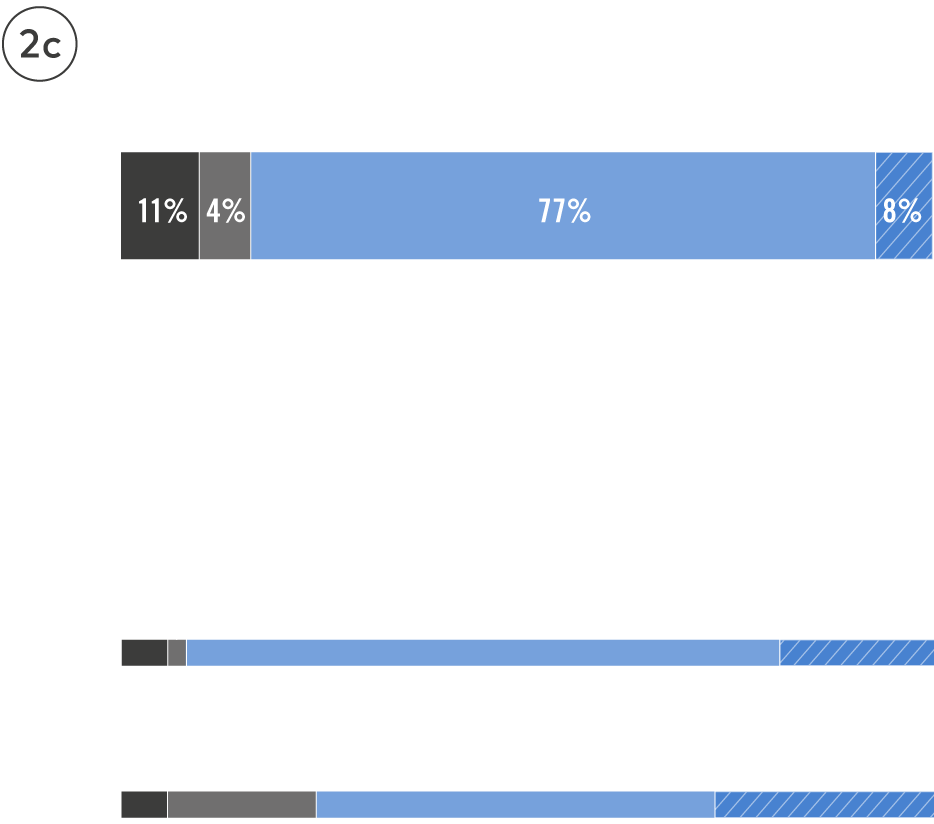

2c Will prescription drug prices be curtailed in the next four years?

III. HEALTH IT SCORE CARD

Innovation continues, with both new technologies entering the fray and new models being tested.

THE EARLY INNINGS FOR AI AND BLOCKCHAIN

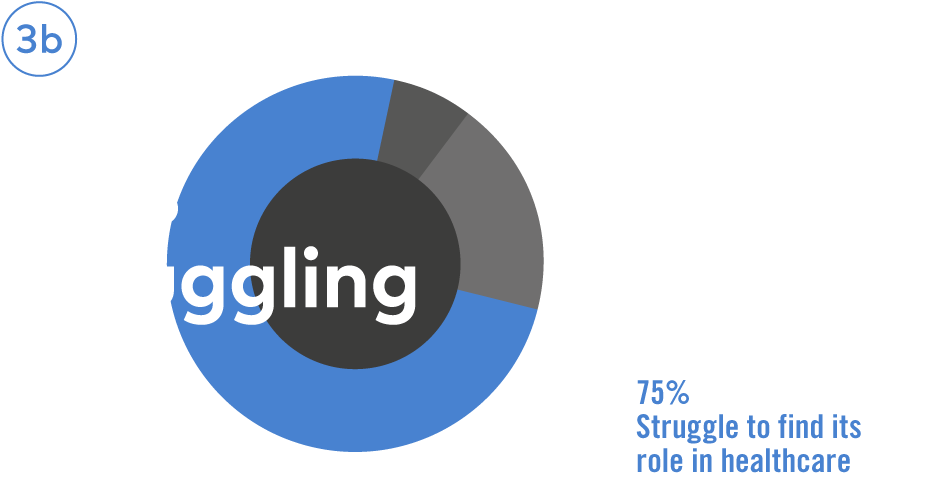

AI is slowly finding its place, while blockchain struggles as much in healthcare as in other segments. At the typical pace innovation matures in healthcare, blockchain may never matter, but there is great confidence that AI will get there with only 1% pessimism.

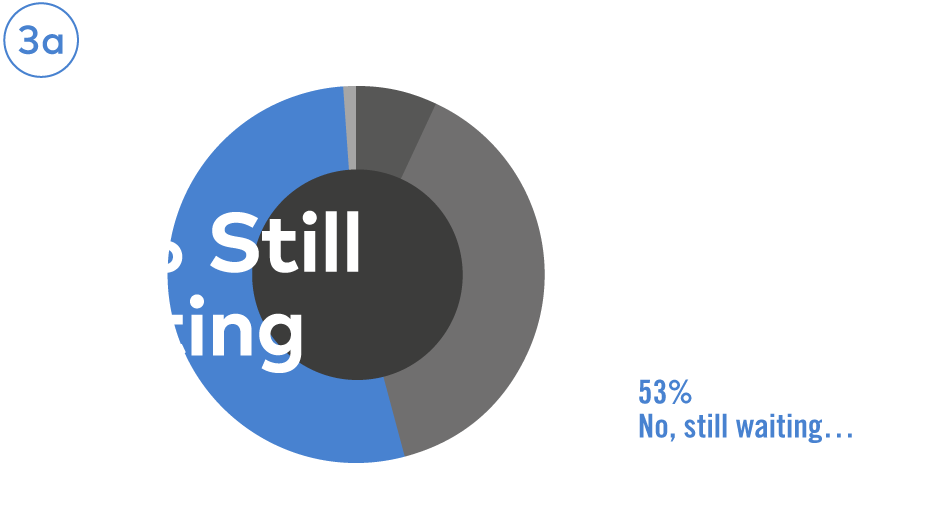

3a Has artificial intelligence made a difference in healthcare?

3b In 2019, blockchain in healthcare will…

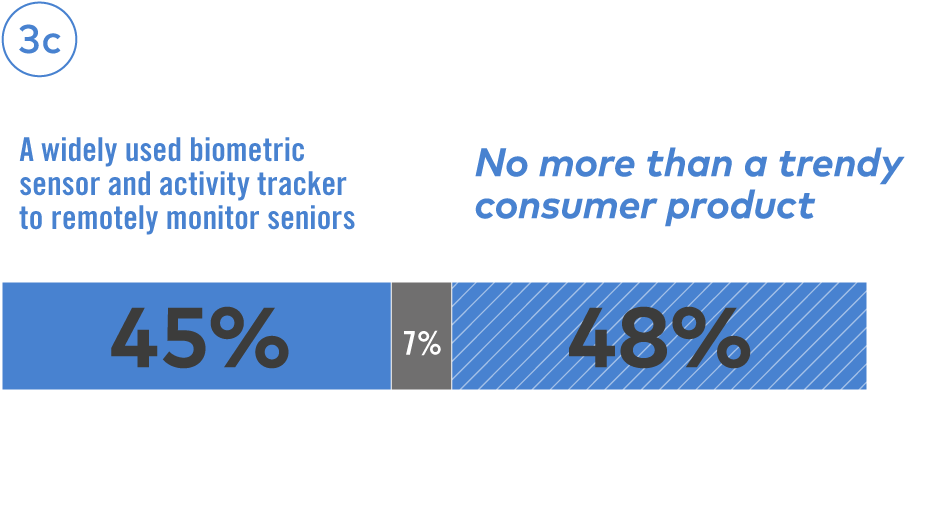

THE APPLE WATCH IS NOT A DX

Our prescient group predicted the outcome of a Stanford study which enrolled over 400,000 Apple Watch wearers… it is not an effective AFib device. Yet, they were split on whether it’s just trendy or will have meaningful utilization for tracking seniors. It remains to be seen whether the study will change opinions on that topic.

3c The Apple Watch is going to be…

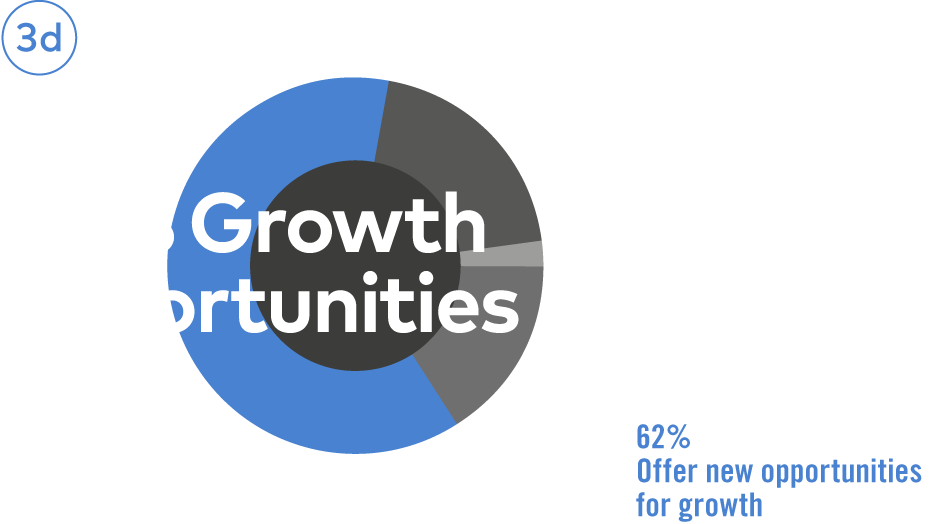

ROSE COLORED GLASSES

Looking ahead to the possibilities of a post 2020 world, a large majority of people see growth opportunities for their business in a Medicare-for-All voucher program. No word on the likelihood of Medicare-for-All actually becoming law. (Pro tip: think low…)

3d A “Medicare-for-All”, where every American gets a voucher to buy a Medicare Advantage-like private insurance plan, would…

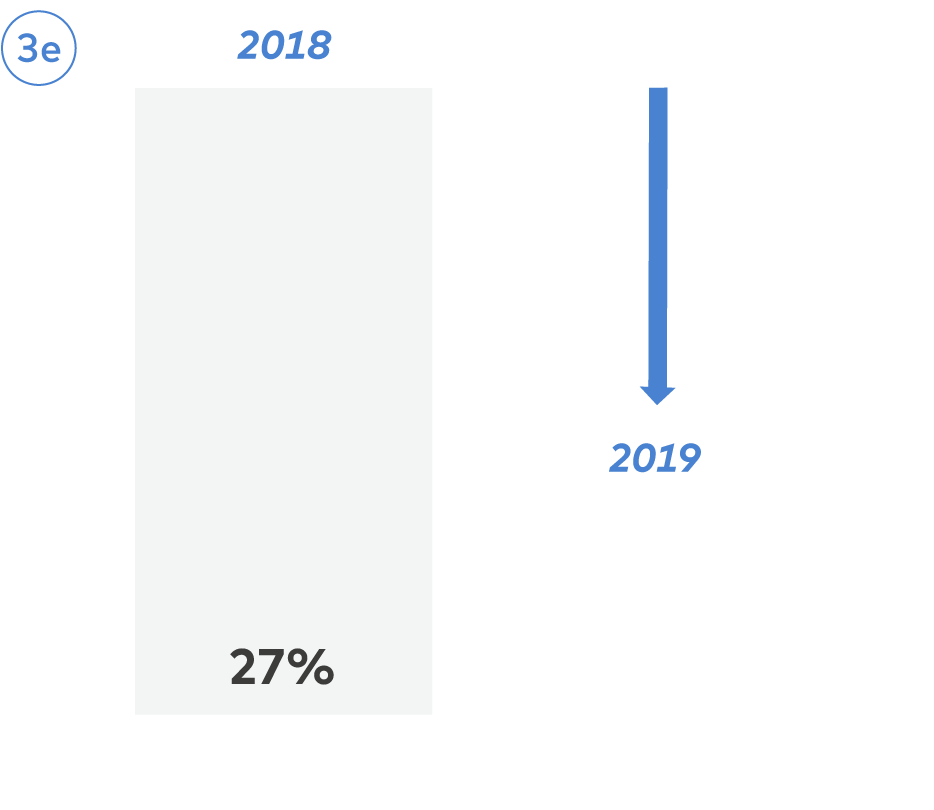

HAVEN HEADED FOR HEAVEN?

The Amazon/Berkshire Hathaway/JP Morgan healthcare partnership faces a sophomore slump of disillusionment, but keep in mind the usual learning curve sees a rebound in the junior year.

3e One year in, how confident are you in the Amazon/ Berkshire/Hathaway/JP Morgan healthcare partnership?

IV. DOING GOOD

Data privacy and diversity are two important issues facing the industry today. How are we doing?

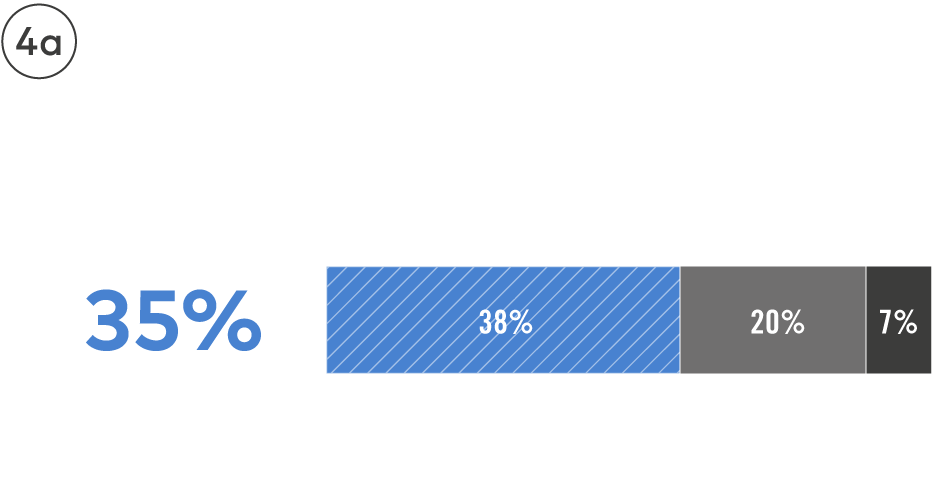

PROPS FOR DIVERSITY

Regardless of how the market is performing, some credit should be given for a sector fostering an overall positive sentiment towards diversity.

4a My organization is making a conscious effort to ensure diversity at all ranks…

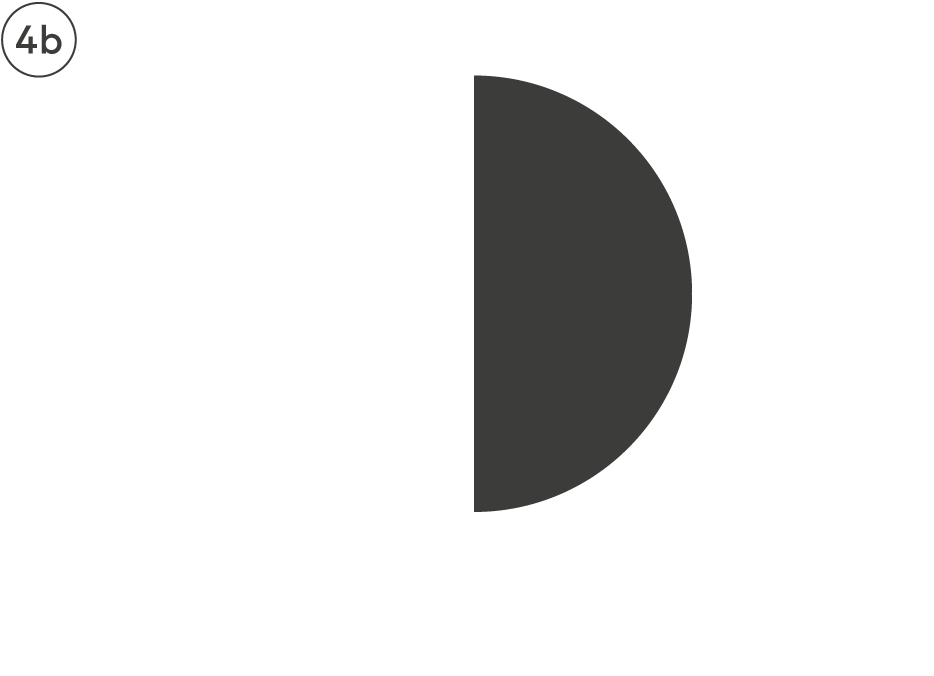

PATIENT PRIVACY — FLIP A COIN

The industry is split down the middle on whether we will see a backlash for violating patient trust and privacy. Like Facebook, isn’t it just a matter of time?

4b The industry is about to face a backlash for violating patient trust and privacy by harvesting and reselling client data…

Full Survey Results

More than 250 respondents from health IT startups, large employers, insurance companies, healthcare providers, academics, the government, investors and professional service providers conducted the survey between March 4, 2019 and March 15, 2019. If you would like to view the results of our previous surveys, you can find them here:

1

Over the next two years, the creation of new healthcare IT companies will:

| 30% | Increase significantly |

| 48% | Increase somewhat |

| 14% | Stay the same |

| 8% | Decrease |

2

Will the following healthcare IT sub-sectors experience growth in the next 12 months?

| Accountable Care Organizations | |

| 12% | Rapid growth |

| 63% | Some growth |

| 21% | No growth |

| 4% | Growth declines |

| Wearables / Consumer Sensors | |

| 36% | Rapid growth |

| 50% | Some growth |

| 10% | No growth |

| 4% | Growth declines |

| Insurance | |

| 16% | Rapid growth |

| 57% | Some growth |

| 24% | No growth |

| 3% | Growth declines |

| Telemedicine | |

| 43% | Rapid growth |

| 50% | Some growth |

| 6% | No growth |

| 1% | Growth declines |

| EHRs | |

| 6% | Rapid growth |

| 38% | Some growth |

| 47% | No growth |

| 9% | Growth declines |

| Digital preventative care programs / wellness | |

| 37% | Rapid growth |

| 53% | Some growth |

| 9% | No growth |

| 1% | Growth declines |

| Analytics and big data | |

| 62% | Rapid growth |

| 32% | Some growth |

| 5% | No growth |

| 1% | Growth declines |

3

What will happen to the capital markets for private healthcare IT companies?

| 22% | Remain strong at all stages |

| 26% | Remain strong for early stage, but become more difficult for long-term growth |

| 36% | Become more difficult for early stage, but remain strong for long-term growth |

| 16% | Become tougher at all stages |

4

How concerned are you about each of the following challenges to healthcare IT innovation in the next 12 months?

| Talent / Hiring | |

| 24% | Very concerned |

| 48% | Somewhat |

| 20% | Neutral |

| 8% | Not at all |

| Regulatory changes | |

| 11% | Very concerned |

| 36% | Somewhat |

| 42% | Neutral |

| 11% | Not at all |

| Economic uncertainty | |

| 19% | Very concerned |

| 45% | Somewhat |

| 30% | Neutral |

| 6% | Not at all |

| Competition | |

| 13% | Very concerned |

| 41% | Somewhat |

| 37% | Neutral |

| 9% | Not at all |

| Funding | |

| 7% | Very concerned |

| 39% | Somewhat |

| 36% | Neutral |

| 18% | Not at all |

5

The Apple Watch is going to be:

| 7% | The most successful atrial fibrillation diagnostic device ever |

| 45% | A widely used biometric sensor and activity tracker to remotely monitor seniors |

| 48% | No more than a trendy consumer product |

6

One year in, how confident are you in the Amazon/Berkshire Hathaway/JP Morgan healthcare partnership?

| 9% | They just might pull this thing off |

| 55% | It’s gonna be a long haul |

| 36% | They still have no idea what they’re getting into |

7

Has artificial intelligence made a difference in healthcare?

| 7% | Yes, meaningfully |

| 39% | Yes, marginally |

| 53% | No, still waiting…. hopefully |

| 1% | No, and it never will |

8

The industry is about to face a backlash for violating patient trust and privacy by harvesting and reselling client data:

| 50% | Agree, there will be consequences |

| 50% | Disagree, nothing will happen |

9

In 2019, blockchain in healthcare will:

| 18% | Find use cases that benefit patients |

| 75% | Struggle to find its role in healthcare |

| 7% | What’s a blockchain? |

10

What does the future hold for hospital consolidation?

| 39% | Speed up |

| 16% | Slowdown due to regulatory hurdles |

| 45% | Slowdown as larger health systems struggle to create value |

11

Will prescription drug prices be curtailed in the next four years?

| 11% | Yes, meaningfully |

| 77% | Only a little, with WAY more talk than action |

| 4% | Yes, voluntarily by pharma |

| 8% | No, nothing will happen |

12

How will the results of the midterm elections impact the future of the US healthcare system?

| 11% | Positive changes are coming |

| 61% | They won’t matter |

| 28% | Is it 2021 yet? |

13

A “Medicare-for-All”, where every American gets a voucher to buy a Medicare Advantage-like private insurance plan, would:

| 16% | Have no impact on my business |

| 62% | Offer new opportunities for growth |

| 20% | Pose huge barriers to growth |

| 2% | Make my business completely obsolete |

14

I believe the following ‘unicorn’ valuations are in line with their market potential (Select all that apply):

| 29% | Oscar Health, $3.2 billion |

| 46% | 23andMe, $2.5 billion |

| 13% | Zocdoc, $2 billion |

| 37% | Devoted Health, $1.8 billion |

| 12% | Proteus Digital Health, $1.53 billion |

| 45% | One Medical, $1.5 billion |

| 6% | Butterfly Network, $1.25 billion |

| 26% | Clover Health, $1.2 billion |

| 18% | Verily, $$$ |

15

Which of the following 2018 early stage (A & B) financings do you regret not having been in?

| 38% | Devoted Health, $300 million, Series B |

| 20% | Lyra Health, $45 million, Series B |

| 22% | Virta, $45 million, Series B |

| 12% | OODA Health, $40.5 million, Series A |

| 6% | Ava, $30 million, Series B |

| 17% | Qventus, $30 million, Series B |

| 22% | Calm, $27 million, Series A |

| 20% | Suki, $20 million, Series A |

| 12% | Solv, $16.8 million, Series B |

| 12% | Other |

16

Which of the following 2018 later stage (Series C on) financings do you regret not having been in?

| 15% | American Well, $290 million, Series C |

| 8% | Butterfly Network, $250 million, Series D |

| 21% | Bright Health, $200 million, Series C |

| 22% | Oscar Health, $165 million, Series G |

| 13% | Collective Health, $110 million, Series D |

| 35% | Livongo, $105 million, Series E |

| 22% | Iora Health, $100 million, Series E |

| 24% | Doctor on Demand, $74 million, Series C |

| 21% | Health Catalyst, $55 million, Series E |

| 9% | Other |

17

My organization is making a conscious effort to ensure diversity at all ranks:

| 35% | We have prioritized diversity from the beginning |

| 38% | We are making progress |

| 20% | We could do better |

| 7% | This is not a priority |

18

Which category best describes your employer?

| 22% | Healthcare IT provider |

| 4% | Large employer |

| 4% | Insurance |

| 13% | Healthcare provider |

| 4% | Academia |

| 0% | Government |

| 27% | Investor |

| 14% | Professional services |

| 12% | Other |

Date: April 17, 2019

Source: Venrock